Agency Loans & Non-Agency MBS – Ultimate Guide

May 11, 2020

Mortgages are the life blood of the real estate market. Without debt financing, the U.S. real estate market would collapse. Investors can enter into the mortgage market in several ways. These include repackaging mortgage notes into residential mortgage backed securities (MBS) and commercial mortgage backed securities (CMBS). In this article, we’ll explore agency loans, non-agency MBS, and CMBS. In a time when interest rates are low, MBS and CMBS offer investors the potential for higher risk-adjusted returns.

Mortgage-Backed Securities

Before we can discuss agency and non-agency loans, we must first define the MBS market. An MBS is a bond secured by a pool of mortgages. The mortgages aggregate into pools with similar characteristics, such as asset class (property type), term, quality, geography, size, and other factors. The pool aggregator assigns the pools to trusts that issue the MBS. Commercial MBS pools derive from commercial mortgages on properties like offices buildings, multifamily residences, retail, hospitality (hotels), and so forth.

How Assets America® Can Help

Commercial Financing – Personal Service – Outstanding Results! Assets America® plays an important part in the CMBS market by arranging commercial property loans possibly suitable for securitization. We offer financing starting at $20 million, with no upper limit. If you are in the market for commercial-property financing, contact us today at 206-622-3000 for a private consultation, or simply fill out the below form for a prompt response!

Apply For Financing

Pass-Through Securities

MBS pass principal and interest payments from mortgage holders to investors via the MBS trust. Typically, MBS pay out monthly. The MBS lose value over time through loan amortization. The metric “MBS factor” is the percentage of the original principal still remaining. MBS pools can source multiple tranches of MBS. Each tranche has specific risk and reward characteristics. When mortgage holders prepay their mortgages, MBS investors collect less interest than they anticipated. This reduces their total return and the price of the MBS. On the other hand, a high default rate by mortgage holders shortchanges MBS investors of both principal and interest. This can lead to steeper losses unless the principal is insured.

Sponsors can repackage existing MBS into collateralized mortgage obligations (CMOs), which we call pay-through securities. Typically, sponsors divide CMOs into tranches that receive payments in a scheduled prioritized order.

Stripped MBS divide principal and interest payments into separate cash-flows that fund interest-only or principal-only bonds.

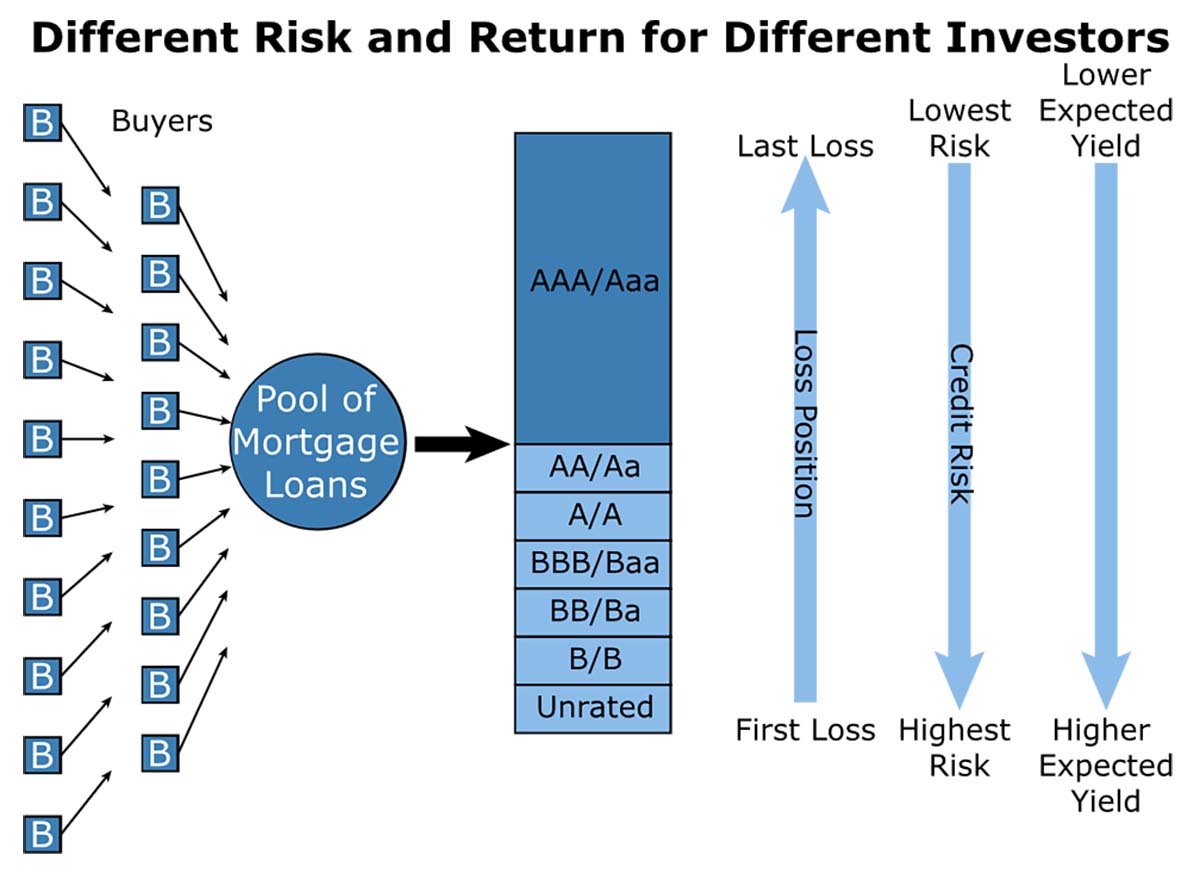

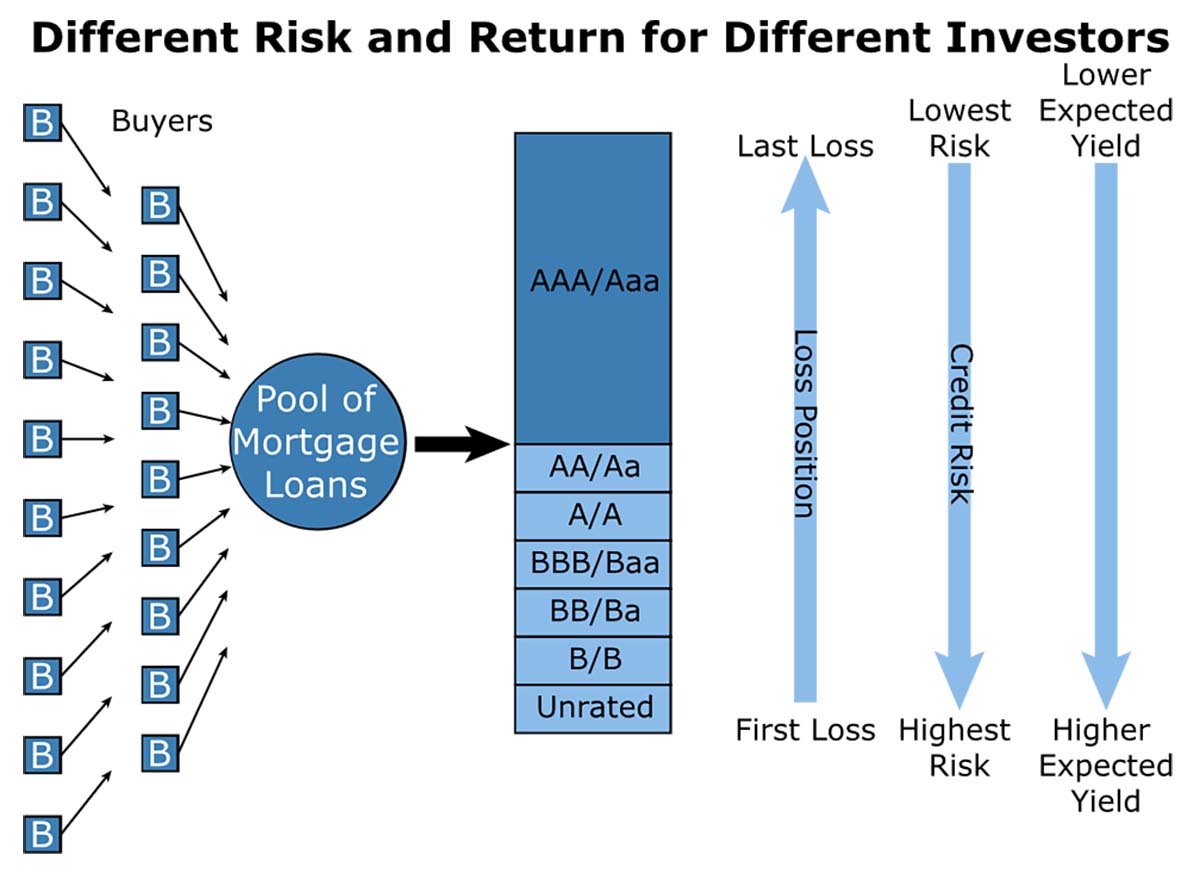

This illustrates the concept of MBS tranches:

The Secondary Mortgage Market

Investors can buy MBS either directly from the sponsor or from existing MBS-holders. Sponsors are either government agencies or private entities such as hedge funds, insurance companies, pension funds, and mutual funds. Purchases in the secondary markets inject liquidity into the mortgage-lending industry (i.e., banks, thrifts, mortgage lenders). The primary lenders sell their mortgages to MBS sponsors, thereby receiving cash that the primary lenders can re-loan to property buyers. The primary lenders remove the mortgage loans from their balance sheets and thus free up capital reserves. In addition, the secondary market helps reduce geographic lending disparities.

Wall Street banks can arbitrage the credit spread between private mortgages and MBS bond rates. This helps to make the markets more efficient.

What are Agency Loans?

Agency loans are MBS created by any of three government agencies:

- Federal Home Loan Mortgage Corp (Freddie Mac)

- Federal National Mortgage (Fannie Mae)

- Government National Mortgage Association (Ginnie Mae)

We call these agency MBS or agency loans. The U.S. government guarantees Ginnie Mae loans, freeing them from default risk. Freddie Mac and Fannie Mae are government-sponsored enterprises (GSEs) whose bonds are not quite as secure as Ginnie Mae’s. But investors regard GSE loans as very safe from default. The underlying mortgages for agency MBS derive from one-to-four-single family residences only (non-commercial).

Agencies can issue TBA (to be announced) securities. Buyers purchase TBAs with given pool characteristics (i.e., coupon, issuer, term, mortgage type, and month of settlement). At a later time (the delivery date), the agencies attach actual mortgage pools to the TBAs. Investors purchase TBAs to lock in their interest rates and hedge other positions.

What are Non-Agency Mortgage-Backed Securities?

Private financial institutions can issue MBS. These are non-agency securities aka private-label securities. Non-agency MBS do not receive any government guarantees. Typically, these securities don’t meet agency standards, consisting of Alt-A and subprime loans. They therefore carry greater credit risk and thus offer higher returns. Non-agency MBS contributed to the mortgage meltdown in 2008.

The market for non-agency MBS dried up during the Great Recession but have since recovered. In 2019, non-agency MBS issuances totaled about $40 billion. New “Ability to Repay” regulations are partly responsible for the recovery.

Agency Loans vs Non-Agency MBS vs CMBS

Residential mortgages secure agency loans and non-agency MBS. Commercial real estate loans collateralize CMBS, which constitute about 2% of the U.S. fixed income market.

CMBS Characteristics

Because commercial properties are unique, the CMBS market is more volatile and complex than that of the MBS market. CMBS are more likely to form tranches. Typically, the trust sponsoring a CMBS issuance is real estate mortgage investment conduit, or REMIC. An REMIC passes cash flows from mortgage pools to CMBS holders without triggering taxes at the trust level.

CMBS carry less prepayment risk because the underlying loans usually contain provisions for prepayment penalties, lockups, defeasance, or yield maintenance (various types of prepayment penalties). CMBS interest may be fixed-rate or floating-rate. Rating agencies assign credit ratings to various CMBS bond classes. Investors purchase CMBS by evaluating their yield, duration, and credit risk. Principal and accrued interest flows to the highest-rated tranches first and then trickles down to lower-quality tranches. We call this structure a waterfall, where holders of the lowest-quality tranches are the first to incur a loss. This most subordinate tranche is the “B-piece.”

CMBS benefit from a value creation effect, where the pool-backed bond value exceeds the total value of the loans. The effect stems from the enhanced structure and liquidity of CMBS, attracting a broad range of investors.

CMBS Risks

As mentioned earlier, CMBS feature lower prepayment risk. However, they do have credit risk. Some CMBS may be privately insured as a way to enhance their credit ratings. CMBS risk varies with the strength of the commercial property market. They also may have credit risk if the mortgage loans were poorly underwritten. Investors can diversify their CMBS purchases via exchange-traded funds specializing in CMBS, such as the iShares Barclays CMBS ETF. Diversification reduces the risk that any one issuance will unduly damage your portfolio.

Are Agency Loans Right for Me?

Agency loans provide an opportunity for investors to enhance their fixed-income yields vs T-bonds and T-notes. Since these loans receive guarantees, they have little or no credit risk. The biggest risk stems from prepayments. Typically, residential mortgages do not penalize prepayments. When interest rates fall, homeowners benefit by refinancing their mortgages at a lower rate. Prepayments reduce the yield on agency MBS loans.

Frequently Asked Question About Agency Loans and Non-Agency MBS

What is the difference between a mortgage and a mortgage-backed security?

A mortgage is a loan from a lender to a borrower secured by property and/or other assets. A mortgage-backed security is a bond secured by a pool of mortgage loans.

What’s the relationship between agency loans and REITs?

Real estate investment trusts (REITs) are an alternative way to invest in real estate. A REIT company owns/operates a portfolio of properties and/or mortgages and are typically managed by highly skilled, professional real estate investor/managers. As a REIT unitholder, you receive a share of the revenues, including rents, interest, and capital gains.

Which agency sets the interest rate on loans?

The Federal Reserve sets short-term interest rates. Agencies don’t set interest rates on MBS. Rather, those rates respond to supply and demand. Investors expect to pay a spread above the Fed Funds rate for agency MBS.